Alan Inskip, the CEO of Tempcover, had a “lightbulb moment” in 2006, which was the idea of an insurance company that could give truly flexible coverage for the amount of time that drivers actually require. There is no commitment for an extended period of time, no automatic renewals, simply the coverage they desire for the duration of time they require. Tempcover was born precisely the following day.

When you might need them

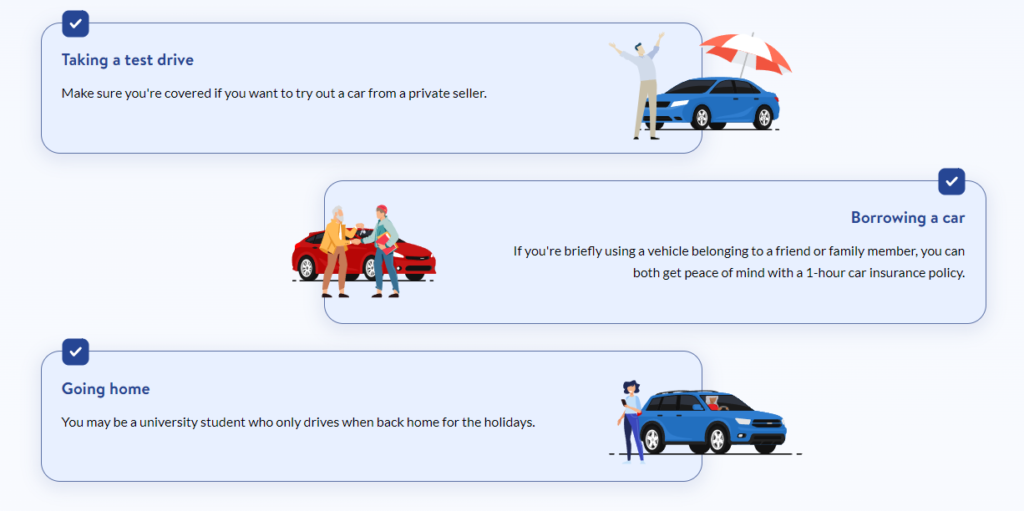

When you find yourself in a situation where you only require a few hours or days of insurance, what do you do? Are you in need of a car or van to borrow for a few of days? Would you like to take a new car for a test drive before you buy it? Want to get some additional practice while you’re learning to drive? Tempcover is available to assist you at these occasions as well as a great many others.

Hourly Car Insurance

Why choose their hourly car insurance?

- Get the cover you need with policies that last from just 1 hour

- No long-term contracts, just a separate policy for the time you need

- No impact on your No Claims Discount. Plus, get fully comprehensive cover as standard

What is 1 to 12-hour car insurance?

Get the coverage you need for those short travels around town, in case of an emergency, or just getting home quickly with hourly auto insurance.

Even though the trips won’t be long, you should nonetheless get adequate insurance before you utilize a vehicle that doesn’t already have it. In many cases, such as when borrowing a friend’s automobile or getting behind the wheel of a brand new motor straight from the showroom, purchasing hourly car insurance is the most prudent and secure course of action.

To prevent potential fines for getting caught without insurance, get quick, easy, and inexpensive hourly car insurance and use another automobile lawfully right immediately. In the event of an accident, you and the owner of the vehicle can rest easy knowing that you are fully covered.

Benefits of hourly car insurance

It’s cheaper

- Just what you require is what you pay for. You are able to obtain coverage for a period of one to twelve hours with one hour auto insurance.

It’s simple

- Decide when you want the service to begin, and then pay for it. After receiving your paperwork, you are now ready to proceed with your plans.

It’s quick

- The only thing they require from you is a few specifics; the turnaround time for your quote might be as little as ninety seconds!

Your No Claims Discount is protected

- There is no effect on the annual No Claims Discount due to the fact that the hourly auto insurance policy is completely independent from the other policies.

How does hourly car insurance work?

A one-hour insurance policy is intended to save you money by providing coverage for the same amount of time that you actually require it.

Additionally, you will not only save money by purchasing auto insurance for one hour, but you will also save time. Simply getting a quote online takes only a minute and a half. There are no questions that are difficult or intrusive; all you need to do is submit some fundamental information about yourself (or whoever you want to be the named driver on the policy) and the vehicle that you want to insure.

After you have provided your information, they will look for a variety of quotations from the insurance companies that they collaborate with and present you with the most affordable option. You can choose from a range of options that extend from one to twelve hours, and you can even add optional extras to your policy.

They will do the comparison work for you so that you can be sure that you are getting the best bargain possible for your situation. When you make a purchase, your insurance certificate will be emailed to you immediately after payment has been made. This will allow you to get on the road as soon as your coverage begins.

When might I need hourly insurance?

Temporary car insurance calculator

The cover you need for the duration you want

Full cover, no impact

- Receive coverage that is completely comprehensive on their basic short-term policies, and your No Claims Discount will not be affected in any way!

Hourly, daily, weekly

- Your coverage can be purchased for a period of time ranging from one hour to twenty-eight days, depending on your preferences. If you don’t require coverage, don’t pay for it!

All customised, nothing added

- You can tailor your insurance to meet your specific needs, from the duration of coverage to the selection of additional coverages that are available as an option.

Why get hourly car insurance from Tempcover?

Whether you’re looking for car insurance to cover you for one hour, two hours or half a day, they can give you the peace of mind that comes with having comprehensive cover precisely when you need it. Here’s why they’re a great choice:

- With more than 15 years of expertise, Tempcover has become the go-to UK provider of hourly insurance for drivers. With their assistance, millions of car owners have been able to secure reasonable, versatile insurance.

- You may receive the policy you need with a selection of options and durations because they deal with a panel of insurers.

- If you or someone you know needs a car for a short period of time, their hourly car insurance products are a great fit.

- It takes next to no time at all to get a quote and set up your cover with them.

- Their expert staff is committed to simplifying the process of gaining access to their flexible hourly policy.

- Their customer-centric approach to an often complex area has garnered acclaim from customers and recognition from other businesses and insurance agencies.

- All things considered, their rating on Trustpilot is ‘Excellent’.

Don’t miss out! Get a £5 Amazon Gift Vouchers when you choose Tempcover insurance

FAQS:

Can you insure a car for an hour?

Yes. The flexible and complete coverage of a regular daily or weekly auto insurance policy is yours for just one hour with hourly auto insurance.

Getting a quotation is simple and fast, and if you need coverage right away, it can start. You pay only for the coverage you use, there are no ties to anything, and there are no long-term obligations.

Oh, and Tempcover offers more than just 1-hour auto insurance. You can select the amount of hours you require, ranging from one to twelve.

Will hourly car insurance affect my No Claims Bonus?

Having to file a claim with them will not impact your No Claims Discount, which is a component of a different annual policy. No Claims Discount will be impacted if you obtain this short-term coverage to protect yourself while driving another person’s vehicle.

What do I need to apply for my hourly insurance?

Requesting a price estimate from them is a simple process. It is recommended that you collect the following information for the online form in order to expedite the process:

- Your car’s registration number

- Your name, date of birth, and address

- Your driving licence number and type

- The estimated value of your car

- Your email address and phone number

- When you’d like your hourly car insurance policy to start

What other types of temporary car insurance can I get?

You can obtain the following from them if you are aware that you require a temporary policy for a period of time that is greater than twelve hours:

- 24-hour car insurance

- Two-day car insurance

- Weekend car insurance

- Weekly car insurance

- Monthly car insurance

So that they can get behind the wheel without jeopardising their No Claims Discount, they now provide short-term insurance tailored to learner drivers. The duration of coverage for these insurance can range from twelve hours to twenty-eight days. Renewing it is all that’s required when it expires!

Was your vehicle released from an impound lot? For the necessary 30 days, they offer a specific coverage for impounded cars that covers you. They understand that every second counts, which is why they can provide you with a quote in as little as 90 seconds. You can save money on storage fees by retrieving your vehicle from the impound as soon as possible.