They chose to shake things up in the vehicle insurance sector because, as drivers, they’ve always been unhappy with the limited choices available to them when they needed a loan car.

they pioneered a novel approach to facilitate the rapid acquisition of basic, uncomplicated short-term insurance for drivers.

Alan Inskip, CEO of Tempcover, had an epiphany in 2006: an insurance company that could supply drivers with very adaptable coverage for the time they actually require. Just the coverage they need, when they need it, with no auto-renewals or long-term commitments required. Tempcover was born the next day.

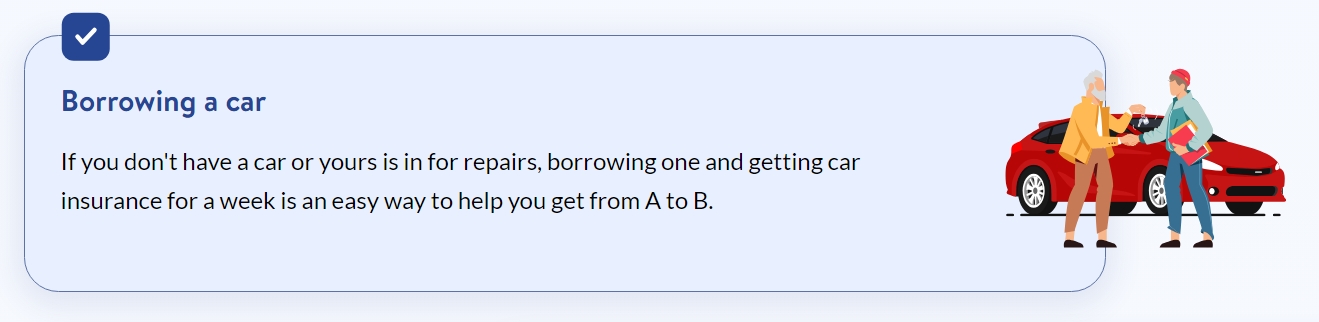

When short-term coverage (a few hours or days) is all that’s needed – A Looking to rent a vehicle for a day or two? Do you want to try out a car before you buy it? Looking for some additional driving practice? This is just one of many situations where Tempcover can be of assistance.

The foundational principle of Tempcover is that insurance can and should be personalised to meet your specific requirements.

They work hard to make traditional insurance less of a hassle by creating new, improved methods that will get you insured faster and more easily.

Delving Deeper Into the Revolution of Tempcover

A fresh idea emerged in 2006 with the launch of Temporary Cover Ltd. Because of the time flexibility it promised, this product swept the insurance industry. A new age had begun in the insurance sector, one that would cater to customers’ evolving wants and demands.

Years 2007–2011: Laying the Groundwork for Trust and Collaboration

Tempcover proceeded to establish relationships with leading insurers and brokers over the following few years, laying the groundwork for its strong coverage structure. These partnerships are largely responsible for the growing confidence in Tempcover’s temporary insurance products and services.

Rebranding and Signing One Million Minds: The Years 2010–2013

In 2010, a big change occurred when ‘Temporary Cover’ changed its name to Tempcover.com, which reflected its growing brand and range of services. After three years, Tempcover reached a significant milestone – selling its one millionth policy. This shows how popular and useful the service has become among drivers.

A Time of Innovation and Evolution: 2014–2019

With Tempcover’s unwavering commitment to innovation, these years stood out. As part of the 2014 redesign, a new website and quotation process went live, greatly improving the user experience. In 2017, Tempcover was honoured with the esteemed Queen’s Award for Enterprise, further confirming its pioneering approach, which was a testament to its persistent innovation.

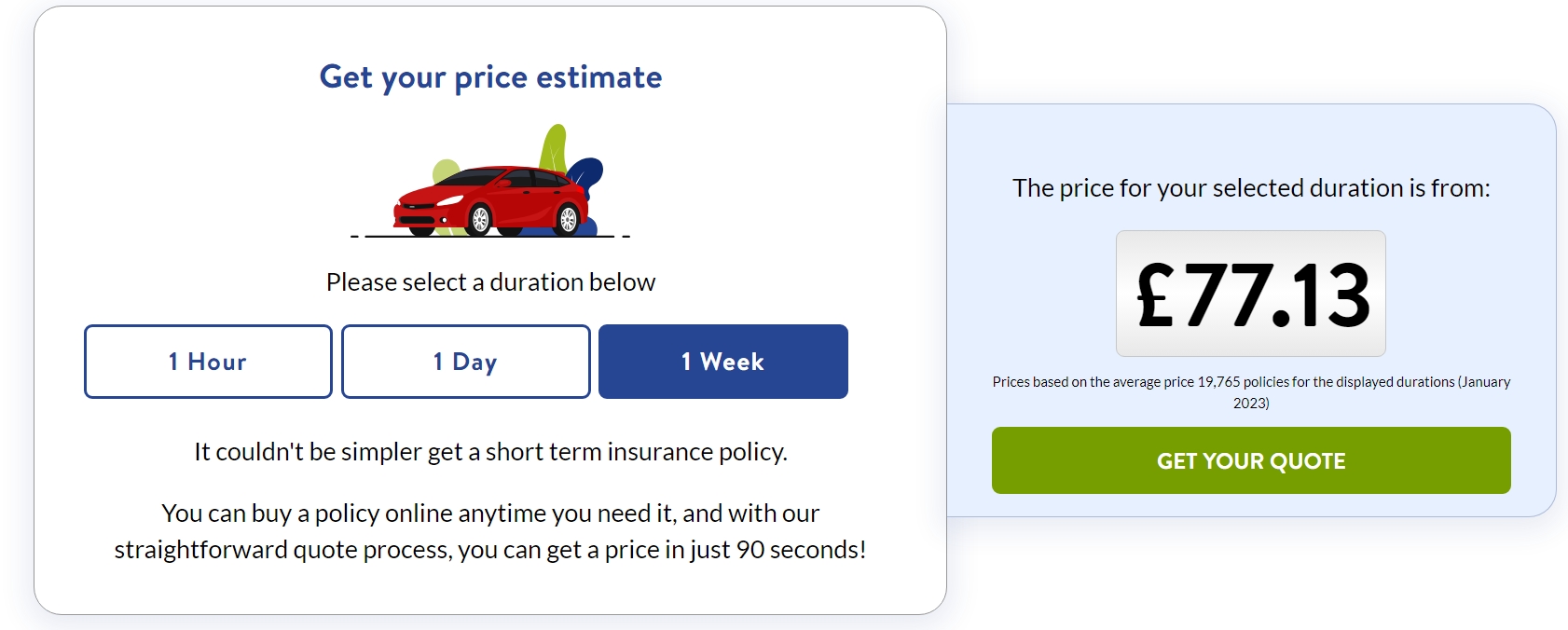

Customers might get the best offer in as little as 90 seconds thanks to a groundbreaking quotation finding procedure that their technological team pioneered in 2019. Tempcover maintained its position as a frontrunner in simplifying the insurance purchase process by dedicating itself to technical improvement.

In 2020 and 2021, the consumer reigns supreme

With the introduction of a frictionless smartphone experience, Tempcover further expanded its 2020 strategic move of entering the car industry with driveaway insurance. Tempcover was also feted at this time by award ceremonies and its large client base, marking another moment of praise.

Years 2022–2023: A New Ownership Structure and Revitalised Goals

There has been a sea change in the last several years, with Tempcover becoming a part of the RVU group, new leadership taking the helm, and the company’s core principles reaffirmed. These were also materialised as a result of both internal and external reflection, bringing the brand’s purpose and principles into harmony with its course of action.

Tempcover Insurance – Redefining Convenience

Weekly auto insurance – what is it?

In a bind and in need of a week’s worth of driving? Finding affordable short-term insurance might be a frightening prospect. You may get the assurance of comprehensive coverage without committing to a yearly policy with options like weekly car insurance.

To avoid legal trouble and safeguard both you and the borrowed or leased car, this sort of insurance is essential, even if your trip will only be a few days long. In this article, you will find comprehensive information on the process of obtaining, the coverage of, and eligibility for a weekly auto insurance policy.

Weekly auto insurance: what does it cover?

Your weekly auto insurance policy will automatically include comprehensive coverage, which will pay for repairs to your vehicle, yourself, and any third parties hurt in an accident.

- Complete coverage for plans ranging from one hour to twenty-eight days.

- Intentional or unintentional harm to your vehicle

- Medical expenses for yourself and others in the event of an accident

- On the road in the UK

- On rare occasions, equivariant or third-party liability insurance while driving in the European Union

Weekly Car Insurance, How Does It Work?

Weekly auto insurance, as you might assume, only covers you for a week. This is all-inclusive auto insurance that works around your schedule. Your one-week auto insurance policy may be set up quickly.

Simply inform them of the vehicle you will be driving, the details of the other drivers, and the start and end dates for your coverage.

Finding the most suitable insurance policy for your needs will then be our next priority as their search their network of providers. Perhaps you have an upcoming vacation or business trip that requires you to travel. Whatever the case may be, their will locate affordable vehicle insurance for a week.

Hourly auto insurance can be a good fit if you just need coverage for a week. Weekend insurance is also an option.

What situations would a week’s worth of auto insurance cover?

What situations would a week’s worth of auto insurance cover?

A weekly auto insurance coverage could be the best short-term option for your requirements, whether you’re in the market for a new vehicle, planning a particular trip, or simply want peace of mind. Taking the wheel without committing to anything long-term is the idea. Get behind the wheel with peace of mind by securing a weekly car insurance coverage, because they’ve got your backs.

With weekly auto insurance, what extras are available?

Coverage for uninsured loss recovery and legal expenses up to £100,000 in the event of an accident that was not your fault. Reduce your policy’s excess to around £100 with Excess Reduction Cover.

Don’t forget that in the event of an accident, you may not have full coverage unless you go for comprehensive coverage. Check your risk tolerance before signing up for a cheap weekly auto insurance coverage, no matter how enticing it seems.

Tempcover offers complete protection, so you can rest easy knowing that their plans cover everything. Whether you’re looking for daily or weekly auto insurance, their provide flexible coverage options to meet your needs and budget.

Take Advantage of Tempcover’s Insurance and Feel Secure Every Week: Your Passport to Convenient Protection and Benefits!

Get Tempcover’s Weekly Insurance and open yourself up to limitless possibilities. Not only does their dynamic coverage protect your trips, but it also opens doors to a realm of perks and opportunities. Tempcover will be at your side every step of the way, whether you’re venturing out into uncharted territory or embracing unforeseen experiences. Reimagine insurance with them, week after week.

Get Ready for an Epic Adventure: Take Your Driving to New Heights with Tempcover Insurance Today and Gain Access to Exclusive Perks and Confidence!